U.S. Dollar Losing Its Reserve Status

The future of the U.S. dollar looks blurry at best. The reserve currency could lose a lot of value in the coming years. Americans beware! A lower dollar could mean a lot of trouble for you.

You see, the value of the U.S. dollar is being questioned a lot these days, and the emergence of a new world currency threatens its survivability for the long term.

The U.S. dollar got its “reserve” status because it was held by central banks around the world and was used in global trade.

Now, we are seeing the emergence of a new currency that central banks are adopting.

It’s the Chinese yuan.

It was added to the International Monetary Fund (IMF)’s Special Drawing Rights (SDRs) not too long ago. We are now seeing central banks adding the currency to their reserves at a very fast pace.

As of the third quarter of 2017, $107.94 billion worth of Chinese yuan was held in official reserves. At the end of 2016, this amount was just $90.78 billion. (Source: “Currency Composition of Official Foreign Exchange Reserves (COFER),” International Monetary Fund, last accessed February 27, 2018.)

If you do simple math, this represents an increase of close to 19% in a matter of a few quarters.

U.S. Dollar Foreign Reserve Allocation Drops

As central banks purchase Chinese yuan for their reserves, the U.S. dollar as a percentage of allocated reserves continues to dwindle.

In the fourth quarter of 2016, the U.S. dollar amounted to 65.32% of all allocated reserves. In the third quarter of 2017, the greenback amounted to 63.34%. Allocated reserves are essentially the reserves that have been used to buy a currency.

The percentage difference may not sound massive, but it’s important to pay attention to the trend.

And that isn’t all…

Know that central banks are essentially wealth managers for their respective nations. They are also very conservative investors in nature. They don’t take risks and want stability in the foreign reserves.

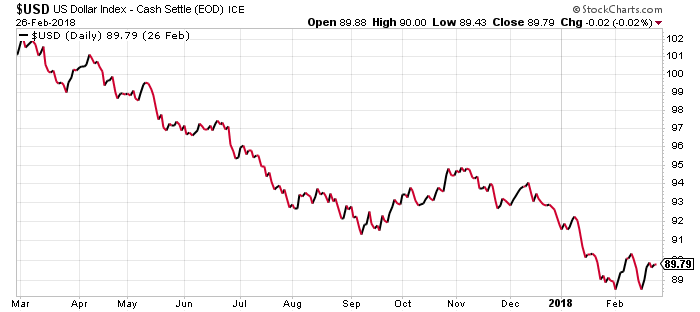

Over the last one year, the U.S. dollar has been a bad investment. It has declined 11.18%.

Just look at the chart below of the U.S. Dollar Index. It tracks the performance of the greenback with major currencies.

Chart courtesy of StockCharts.com

Sadly, the fundamentals—massive national debt, the government spending without remorse, fiscal policy uncertainty, political deadlock, and a possible slowing economy—call for a much lower value for the greenback as well.

Do you really think that central banks will favor the U.S. dollar in the coming months and quarters? It’s very hard to imagine that this could be the case.

Why a Lower U.S. Dollar Could Hurt Americans

Dear reader, looking at all this, it’s a likely scenario that the U.S. dollar could lose a lot of value in the coming months and quarters.

So, know that a lower dollar means higher costs for Americans.

Inflation in the U.S. economy is already accelerating. As the greenback loses value, it wouldn’t be shocking to see prices moving higher quickly. This could really hurt consumption of Americans. All of a sudden, they might find themselves paying more for things like gas and food. Ultimately, this hurts the overall economy.

Right now, if you listen to the mainstream, no one seems to be concerned about the U.S. dollar. I am pessimistic toward the dollar and believe that it could be a catalyst for a lot of problems ahead.